Letters of Credit

A Letter of Credit (LC) is a widely used trade finance instrument that guarantees payment from the buyer’s bank to the seller, provided that all terms and conditions in the LC are met.

Letters of Credit are especially useful in international trade, where trust and risk mitigation are crucial. They offer protection to both exporters and importers by ensuring that funds are only released when agreed documentation is presented—such as shipping documents, invoices, or inspection certificates.

Types of Letters of Credit:

Revocable/Irrevocable LC

Confirmed LC

Sight LC

Usance LC

Transferable LC

Back-to-Back LC

Benefits:

Reduces payment risk

Encourages smoother international transactions

Ensures compliance through document verification

Offers financing options for both parties

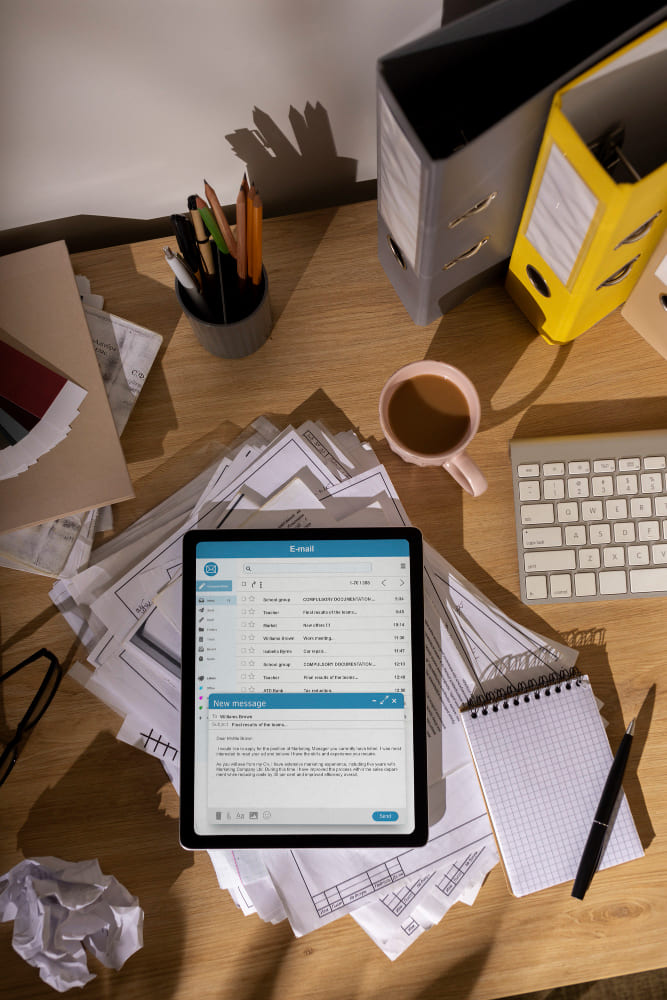

Agreement & Application

The buyer (importer) and seller (exporter) agree on the terms of the sale. The buyer applies to their bank to issue a Letter of Credit in favor of the seller.

Issuance & Confirmation

The buyer’s bank (issuing bank) sends the LC to the seller’s bank (advising or confirming bank), verifying the buyer's ability to pay and the terms under which payment will be made.

Shipment & Documentation

The seller ships the goods and submits the required documents (e.g. bill of lading, commercial invoice) to their bank, proving that shipment complies with the LC terms.

Verification & Payment

The advising bank verifies the documents and forwards them to the issuing bank. If all documents are in order, payment is released to the seller. The buyer then receives the shipping documents to collect their goods.

Contact Information

If you have a finance enquiry, please use the contact form.

Otherwise, you can reach us on the email addresses below.

St. George Commercial finance Brokers Limited

11 Curtis House,

34 Third Avenue,

Hove,

BN3 2PD

07958 710 010

01273 855 711

01273 855 710

Letters of Credit

Letters of Credit are secure payment instruments used in international trade, ensuring sellers get paid upon meeting conditions. Issued by banks, they reduce risk for both buyers and sellers.

A Letter of Credit (LC) is a bank-issued guarantee that ensures a seller receives payment from a buyer, provided that agreed documents and conditions are met.

Importers, exporters, manufacturers, and traders commonly use LCs in international transactions to reduce the risk of non-payment or non-shipment.

Typical documents include a commercial invoice, bill of lading, packing list, insurance certificate, and any other documents specified in the LC terms.

Common types include Commercial LC, Standby LC, Confirmed LC, and Transferable LC — each serving different levels of risk protection and transaction flexibility.

Once all terms are agreed upon, an LC can typically be issued within 2–5 working days, depending on the complexity of the transaction and the bank’s processing time.